Excitement About Top 30 Forex Brokers

Wiki Article

The 30-Second Trick For Top 30 Forex Brokers

Table of ContentsTop 30 Forex Brokers Can Be Fun For Everyone8 Simple Techniques For Top 30 Forex BrokersRumored Buzz on Top 30 Forex BrokersHow Top 30 Forex Brokers can Save You Time, Stress, and Money.The Best Guide To Top 30 Forex BrokersFascination About Top 30 Forex BrokersSee This Report on Top 30 Forex Brokers

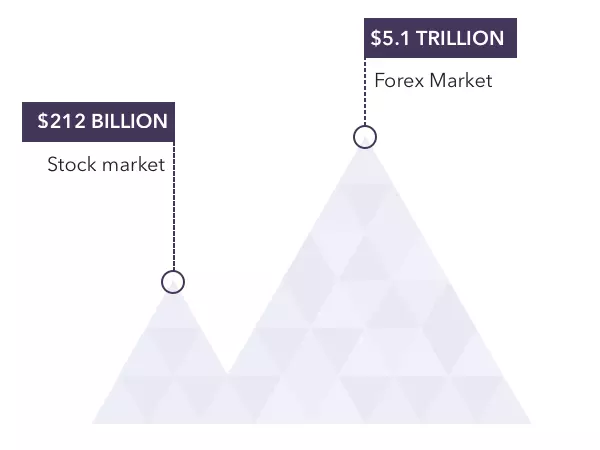

Nevertheless, foreign exchange trading has its drawbacks, such as high threat and volatility. Forex is the largest and most fluid market worldwide. Trillions of dollars worth are traded every day. A profession as a forex trader can be lucrative, versatile, and very interesting. There is a steep knowing contour and foreign exchange traders deal with high dangers, leverage, and volatility.

They include: Foreign exchange trading can have extremely low expenses (brokerage firm and payments). There are no payments in a real sensemost foreign exchange brokers make profits from the spreads between foreign exchange currencies.

Unknown Facts About Top 30 Forex Brokers

The foreign exchange markets run throughout the day, enabling professions at one's comfort, which is extremely beneficial to temporary investors who tend to take positions over brief durations (say a couple of minutes to a few hours). Couple of traders make trades during total off-hours. For instance, Australia's daytime is the nighttime for the East Coastline of the U.S.service hours, as little development is expected and rates are in a secure variety during such off-hours for AUD. Such investors take on high-volume, low-profit trading approaches, as they have little earnings margins as a result of an absence of advancements certain to forex markets. Instead, they attempt to make revenues on fairly stable low volatility duration and make up with high quantity trades.

Foreign exchange trading is really fitting in this method. Contrasted with any kind of various other economic market, the forex market has the biggest notional value of day-to-day trading. This gives the greatest level of liquidity, which indicates even big orders of currency professions are conveniently filled up efficiently without any kind of big cost variances.

Unless major occasions are anticipated, one can observe comparable price patterns (of high, mid, or reduced volatility) throughout the continuous trading.

Getting The Top 30 Forex Brokers To Work

Such a decentralized and (relatively) decontrolled market assists stay clear of any type of sudden surprises. Compare that to equity markets, where a business can unexpectedly declare a reward or record huge losses, resulting in big cost modifications. This low level of regulation also helps maintain expenses low. Orders are straight put with the broker who executes them by themselves.The significant money often present high rate swings. If professions are put sensibly, high volatility helps in huge profit-making opportunities. There are 28 significant currency sets entailing eight major money. Requirements for choosing a set can be convenient timing, volatility patterns, or financial advancements. A forex investor who enjoys volatility can quickly switch from one money pair to an additional.

Top 30 Forex Brokers Fundamentals Explained

Without more capital, it may not be possible to trade in various other markets (like equity, futures, or alternatives). Availability of margin trading with a high take advantage of variable (approximately 50-to-1) comes as the topping on the cake for forex trades. While trading on such high margins comes with its own dangers, it additionally makes it much easier to obtain far better profit capacity with limited capital.Because of the plus size of the forex market, it is much less prone to insider trading than some recommended you read other markets, particularly for major currency sets. Nonetheless, it is still sometimes based on market adjustment. Basically, there are great deals of benefits to forex trading as an occupation, but there are disadvantages too.

Some Known Questions About Top 30 Forex Brokers.

Being broker-driven ways that the foreign exchange market might not be fully clear. A trader might not have any kind of control over exactly how his trade order gets fulfilled, might not obtain the very best rate, or may get limited sights on trading quotes as given only by his picked broker. An easy option is to deal just with regulated brokers who drop within the province of broker regulators.Forex rates are affected by multiple aspects, mainly global national politics or economics that can be tough to evaluate information and draw dependable final thoughts to trade on. A lot of foreign exchange trading occurs on technical indications, which is the key reason for the high volatility in forex markets. Getting the technicals wrong will lead to a loss.

Top 30 Forex Brokers Fundamentals Explained

Forex investors are totally on their very own with little or no assistance. Disciplined and constant self-directed understanding is a should throughout the trading career.

Report this wiki page